The economics of Varda Space Industries manufacturing drugs

28 Jun 2023

I was recently intrigued by the story of Varda who is launching satellites to kick start manufacturing in microgravity. This not only scratches my love of sci-fi itch but is also inspirational in terms of the team’s ability to execute and get a payload into space. At this point I’d be happy for them and watching from the sidelines however this detailed blog post by NotBoring.Co outlines much more of Varda’s strategy, with the first vertical being drug manufacturing so I had to dive in deeper.

Of course the reality is that the “manufacturing” is not total product synthesis but rather a piece of the manufacturing pipeline which is the preparative crystallization of the drug API (active pharmaceutical ingredient), that is highly dependent on upstream terrestrial manufacturing.

In short, preparative crystallization is a common technique used in organic synthesis for the recovery of a synthesis product that is dissolved in a solvent. By crystallizing the product you can physically separate it from the liquid solvent by filtration, in addition the nature of the product being a crystal means that you purify chunks of pure molecule from a mixture of contaminants and solvent. In the NotBoring.Co blog post and this excellent blog post by Corin Wagen you can learn more about the challenge of polymorphic crystallization and how crystallization within microgravity can help achieve more mono-disperse particle sizes of crystals.

“Shooting APIs into space, waiting for them to crystallize, and then launching them back to Earth is going to be really expensive, and Varda will have to demonstrate extraordinary results to justify the added hassle—particularly for a technique that they hope to make a key part of the pharmaceutical manufacturing process. Talk about supply chain risk! (Is this all going to be GMP?)” - Corin Wagen

I wanted to think through the unit economics of this proposition and think about the value to the pharmaceutical industry of preparative crystallization in microgravity. I want to note that crystallization is used also in an analytical approach to determine the structure of a protein, you would want to grow a crystal and determine the structure via x-ray diffraction, I won’t be analyzing that case here as that, whilst important, is not manufacturing.

For the following analysis I have had to make assumptions and generalizations and I will try and highlight these and the rationale for the choices.

Some basics on the launch payload

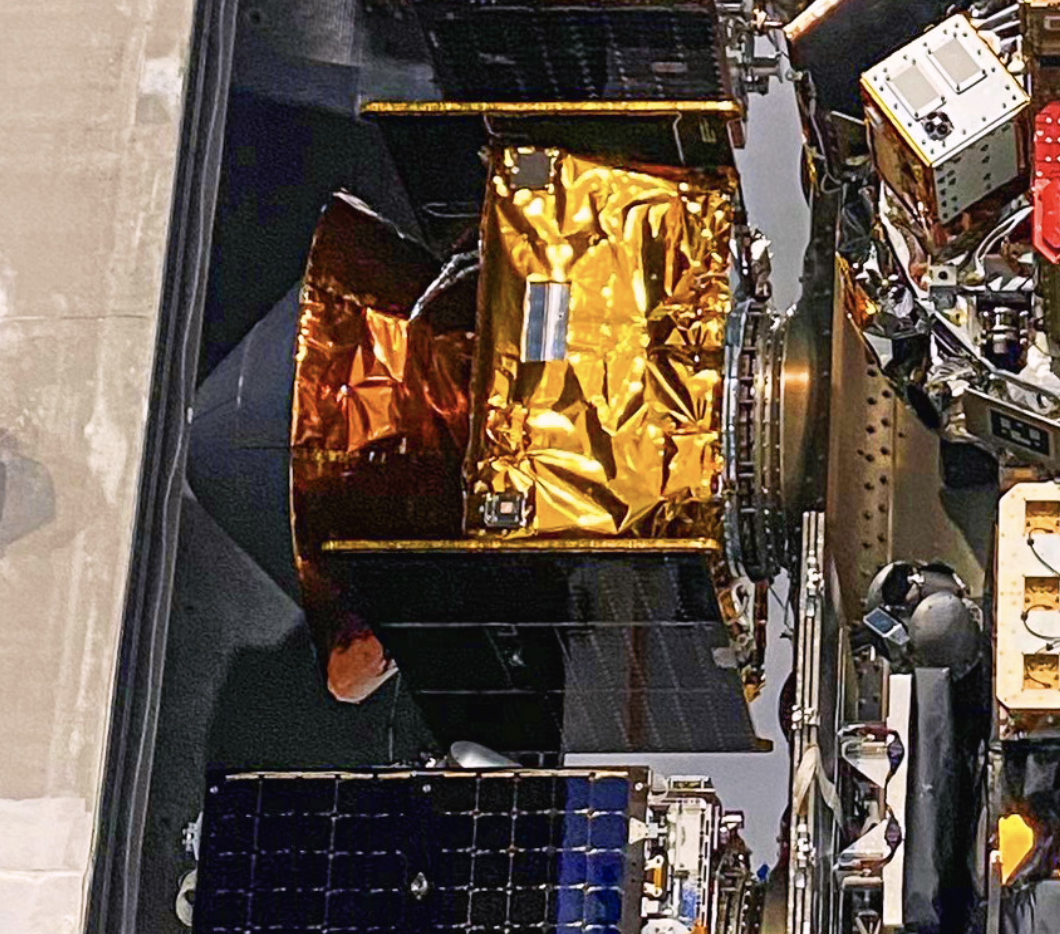

Here is a photograph of the launch payload, you can see the large cone on the front, this is the manufacturing and recovery capsule that will be separated from the RocketLab Photon Bus. The manufacturing and recovery module payload mass is 120kg, The module needs to contain all of the hardware to perform the re-crystallization in addition to the materials: unprocessed API and crystallization solvent. So in terms of manufacturing mass we have a 120kg budget to play with, some fraction of this will need to be assigned to the unprocessed API, to be clear, there is no new API being created on this module so it’s currently not possible to get more finished API out than unprocessed API going in, so we would want to maximize the fraction of payload mass consumed by unprocessed API. Let’s also estimate the volume of the recovery capsule by modeling it as a sphere and assuming a diameter of 1.75m, giving 2.8m3 or 2800L.

Fig. 1 - A person standing next to the Varda capsule attached to a RocketLab Photon One could estimate the capsule is 1.75m in diameter based on this image.

Fig. 1 - A person standing next to the Varda capsule attached to a RocketLab Photon One could estimate the capsule is 1.75m in diameter based on this image.

Fig. 2 - Another view of the Varda capsule The capsule is attached to a RocketLab Photon which is then mounted on an ESPA ring, appearing a test.

Fig. 2 - Another view of the Varda capsule The capsule is attached to a RocketLab Photon which is then mounted on an ESPA ring, appearing a test.

Fig. 3 - A view of the Varda payload This view shows the Varda payload mounted to an ESPA ring, not shown are other payloads attached via ESPA ring ready for launch.

Fig. 3 - A view of the Varda payload This view shows the Varda payload mounted to an ESPA ring, not shown are other payloads attached via ESPA ring ready for launch.

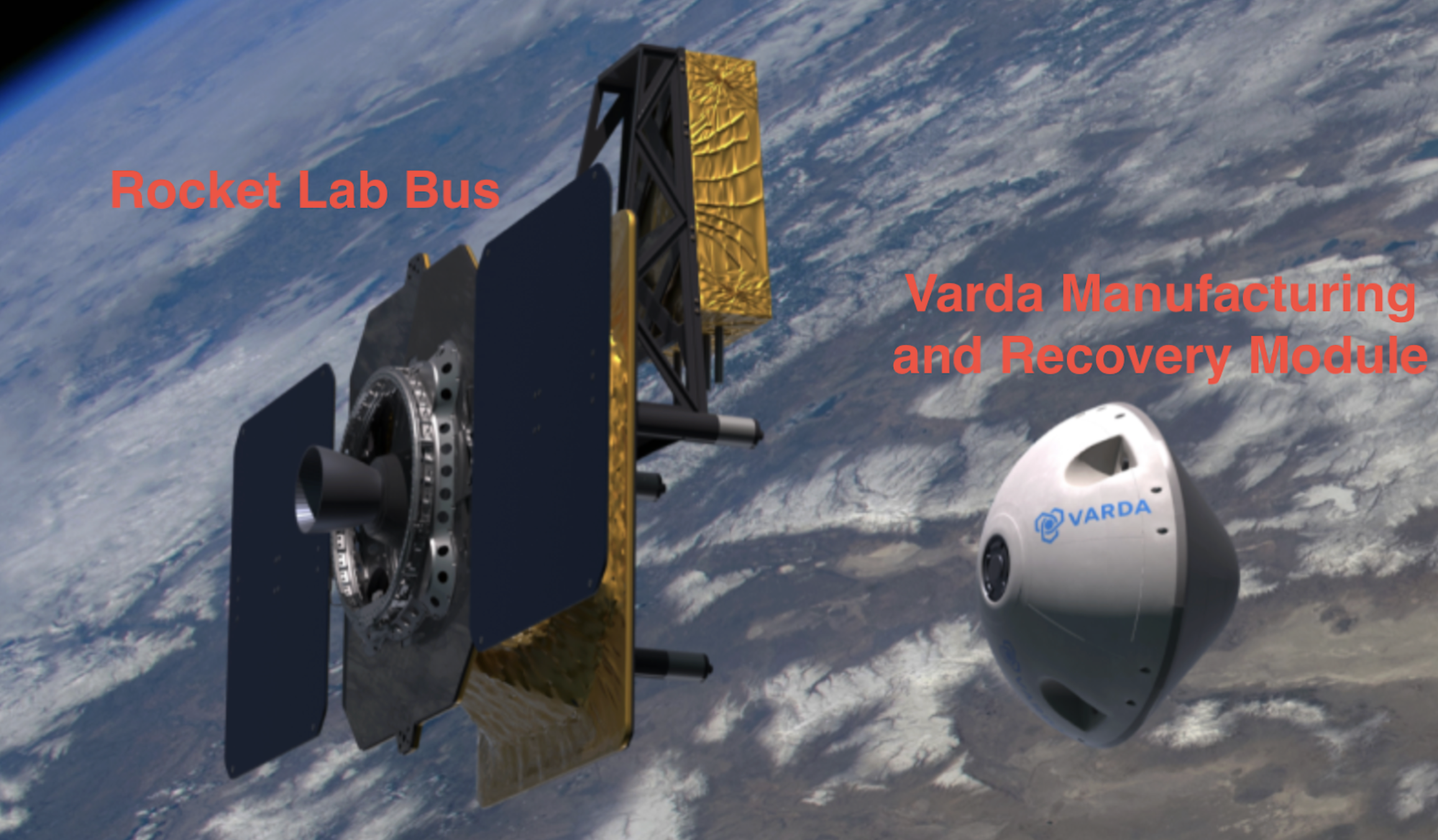

Fig. 4 - A CG render shows the capsule separating from the Photon In this render we can see the two parts from RocketLab and Varda

Fig. 4 - A CG render shows the capsule separating from the Photon In this render we can see the two parts from RocketLab and Varda

It was stated by Delian (co-founder of Varda) that the manufacturing takes place in the conic module:

Some background on APIs mentioned by Varda

Ritonavir is the first drug being re-crystallized by Varda in microgravity from the NotBoring substack:

“Its second priority will be running tests on ritonavir, an HIV/AIDS treatment from the 1990s that needed to be reformulated because of stability issues related to the crystalline form of the drug. Showing that microgravity would have helped AbbVie avoid the need to reformulate Ritonavir would be a cherry on top, but as long as that capsule lands safely in Utah in mid-July, the first flight will be a success.” - notboring

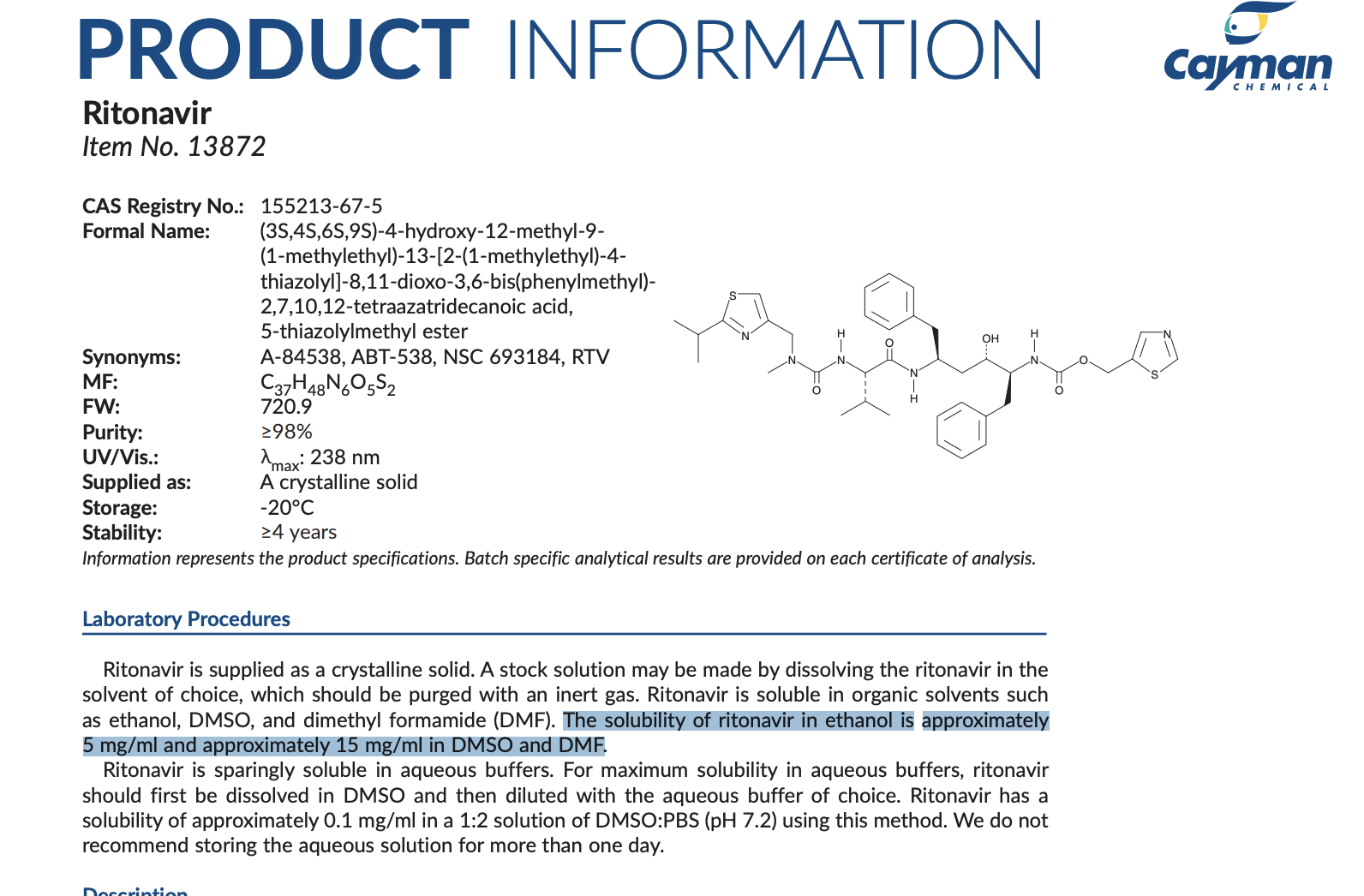

Ritonavir is a protease inhibitor used to manage viral infections primarily HIV however it is not used as the primary treatment, often is a combination agent along with a primary anti-retroviral. More info here https://www.accessdata.fda.gov/drugsatfda_docs/label/2017/209512lbl.pdf

Dosing for Ritonavir as a maintenance agent in combination with another therapy appears to be in the range of 400mg daily. To give an indication of numbers and demand for Ritonavir, though Ritonavir appears to not be the standard of care, it is estimated that in 2019 1.2 million Americans had HIV. To be clear Ritonavir is being used as a test agent and Varda has not given any indication this is anything more than a proof of concept API, however it is something they have a lot of focus on given its polymorphism which they published on at the end of 2022 in Crystal Growth & Design.

In terms of Ritonavir’s solubility it ranges from 0.1mg/mL in 1:2 DMSO:PBS, 5mg/mL in ethanol up to 15mg/mL in DMSO and DMF. This information is shown below from Cayman Chemicals

If Ritonavir is a proof of concept API why am I using it in the models?

1) Ritonavir seems to poster child of polymorphic crystallization for Varda

2) Ritonavir is a small molecule API which is most amenable to simple recrystallization as opposed to a monoclonal antibody crystallization

3) Ritonavir has a representative solubility range

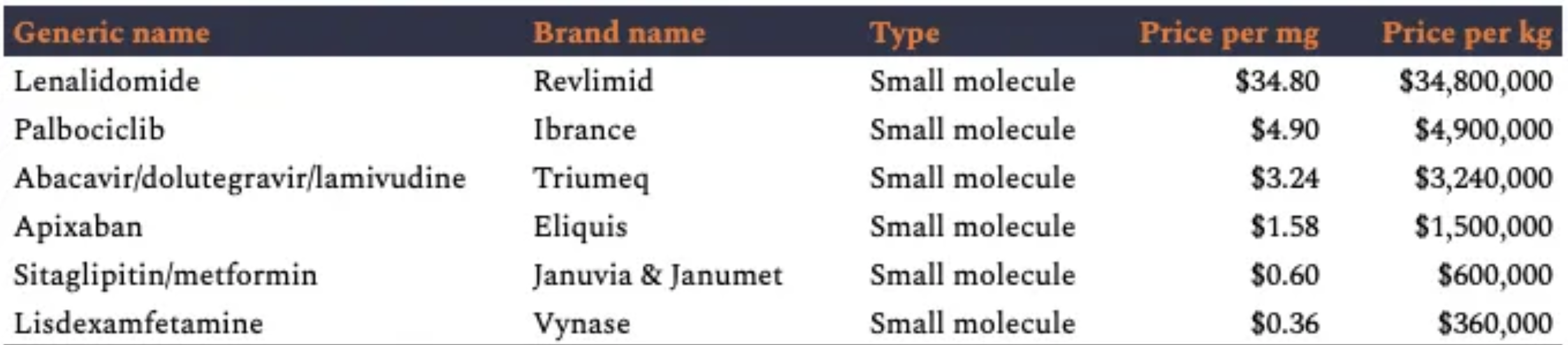

Just a note for most of the model I use a commercial value of $1.58/mg, that of Eliquis being a popular molecule and trying to be representative. Ritonavir itself has a price approximately of $0.1/mg, more information on Ritonavir pricing is summarized here. More commercial API rates from the NotBoring blog post are shown in this table below.

Analysis

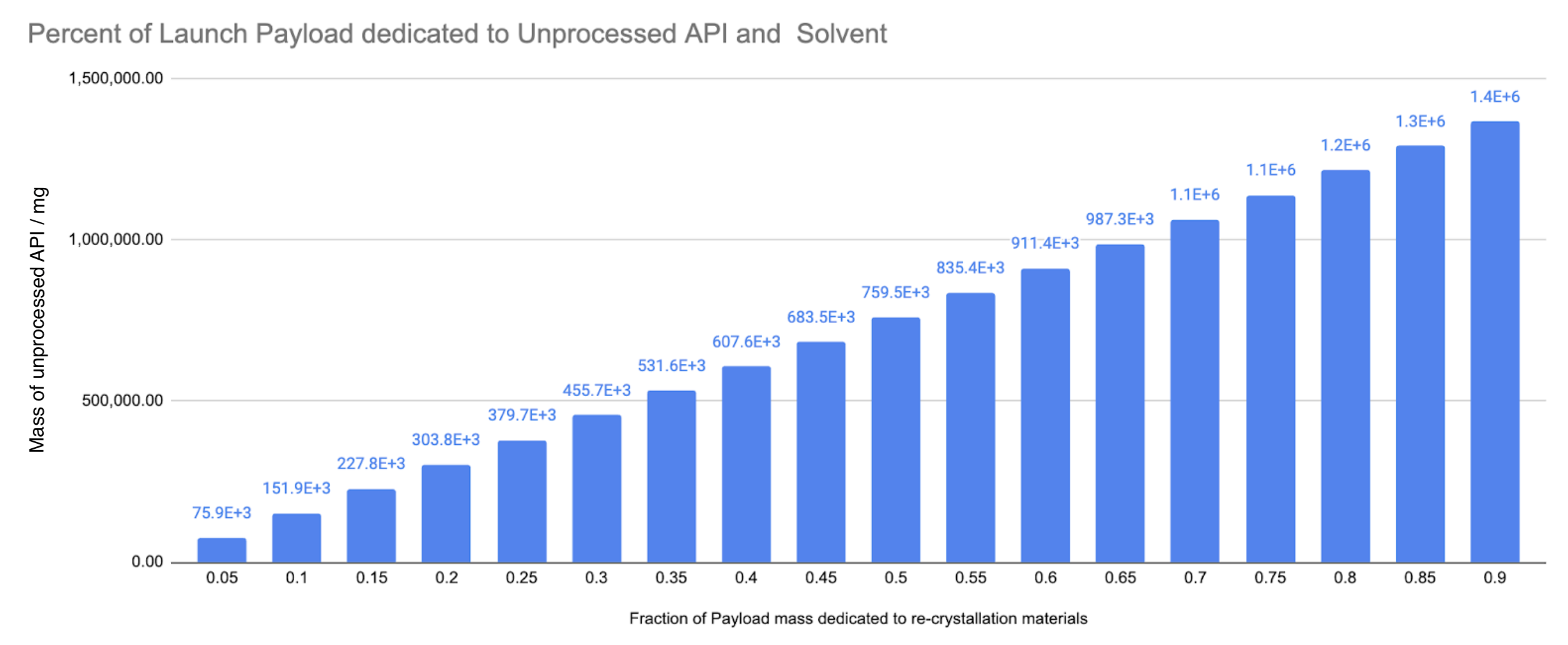

The dependence of unprocessed API mass on fraction of payload mass dedicated to manufacturing materials

As previously stated no new API is getting made in the configuration so whatever you send up is the max you get back on Earth, hence one would want to send as much unprocessed API as possible. We know in the current mission we have a 120kg payload mass to play with however we don’t know much of that dedicated to hardware for doing the re-crystallization vs mass of the unprocessed API and materials for recrystallization like solvent.

In the following analysis I do a sweep of fraction of the payload mass (120kg) dedicated to materials (not hardware) from 5% to 90%. In this analysis here are my assumptions:

Parameters

Payload Mass: 120kg

API solubility: 10mg / mL (Ritonavir can see a range of 4-10 mg/mL across solvents)

Solvent: Methanol (some examples give a mixture of acetone, DCM, and water, what’s important here is the density mg / mL as that is what will take up the payload mass budget)

Methanol density: 790mg / mL

No solvent re-use

Fig. 5 - Percent of Payload Mass Budget for Manufacturing Materials vs Raw API mass

Fig. 5 - Percent of Payload Mass Budget for Manufacturing Materials vs Raw API mass

You can see at the low end of 5% of payload mass we can launch 75g of API, at the top end of 90% of payload mass we can launch 1.4kg of API. Assuming the module itself, is having to stand up to atmospheric re-entry, it could be at least 50% of the mass of the recovery module therefore the mass dedicated to materials is 0-50%, but I would guess even lower, perhaps 25% is a good guess, which would mean 380g of API can be launched.

Ok 380g of API is a little rough, in terms of Ritonavir maintenance doses, when it is supplementary to another protease inhibitor at a 400mg/day dosing this is 950 doses, per launch and recovery. Let’s talk about the amount of solvent that we need to send to space to accompany the unprocessed API.

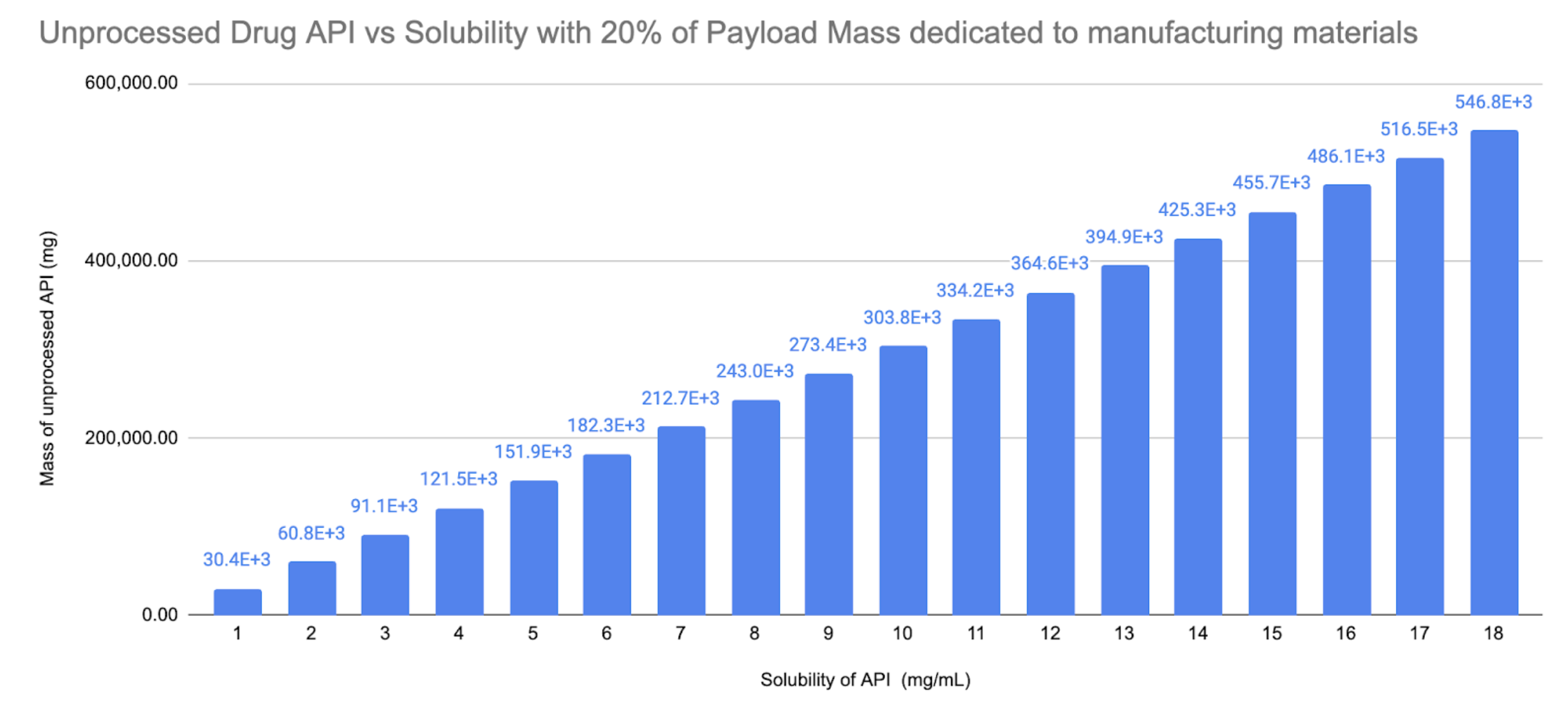

The dependence of API solubility vs total mass budget for unprocessed API

When recrystallizing you need to get your API into a solution then either change the temperature or the composition of that solvent mixture that will lower the capacity of the solvent to accommodate the solute. After your material transitions from a solution into solid crystals you will then want to filter off the remaining solvent leaving you with the solid crystals. It is unclear if the finished product returning to Earth is filtered solid particles or a suspension of crystals dispersed in the solvent. Adding filtration will take more mass from the total mass budget.

Let’s look at the case for a solubility of 1mg/mL. That means that 1mg of solid material can be dissolved in 1mL of solvent. If that solvent is Methanol, the density of methanol is 790mg/mL. So for every gram of API you want to launch into space you also have to launch 790 grams of solvent.

Let’s look at the dependence of unprocessed API launched vs the solubility of the API in the chosen solvent with the following assumptions:

Payload mass dedicated to manufacturing materials: 20%

API: Ritonavir

Solvent: Methanol

Methanol density: 790mg/mL

No solvent re-use (if solvent was being re-used this would contribute to hardware mass more on this later)

Fig. 6 - API Solubility vs Mass of API

Fig. 6 - API Solubility vs Mass of API

At the low end of solubility of 1mg/mL we could launch 30g of API, at the high end at 18mg/mL we could launch 546g of API. For Ritonavir this is 75 up to 1,365 400mg daily doses.

There’s really no two-ways about this, for any economically viable shot at scaling manufacturing like this you need to launch way more API than solvent so you have to reduce the amount of solvent being used. It’s possible to achieve higher levels of solubility with different solvents at different temperatures but nothing that is going to unlock sufficient scaling. The only option is solvent re-use.

What does solvent re-use entail and what parameters would that give us

For GMP solvent re-use you typically need to have a process in place to purify your solvent and QC that the purity falls within an acceptable regime. In brief you would filter your solids from the solvent, then purify the solvent. This purification could be by distillation or reverse osmosis depending on the expected contaminants. QC may be measured by LC/MS.

Now typically when crystallizing for purification you will intentionally want to leave impurities such as side-products or unreacted reagents within the solution separate from your crystallized product, hence GMP is expecting the solvent to not be fit for re-use as it contains impurities. In Varda’s case if the unprocessed API is highly pure, there may be a rationale to say that there is no requirement for processing the solvent beyond filtration to remove the previous batches crystal products. If this is the case the only considerations should be the time it takes per cycle of crystallization and filtration, and the operational hardware to accomplish 100’s of cycles of this without failure.

To quickly look at how many batches need to be processed based on the quantity of API to be processed:

Assuming:

Recrystallization reactor capacity: 5kg of solvent

Solubility is 10mg / mL

Solvent is methanol

Methanol density is 790mg/mL

Solid API processed per batch is: 63g

| Number of batches | Total API to process / mg |

7.90 |

500.0E+3 |

15.80 |

1.0E+6 |

23.70 |

1.5E+6 |

31.60 |

2.0E+6 |

39.50 |

2.5E+6 |

47.40 |

3.0E+6 |

55.30 |

3.5E+6 |

63.20 |

4.0E+6 |

71.10 |

4.5E+6 |

79.00 |

5.0E+6 |

86.90 |

5.5E+6 |

94.80 |

6.0E+6 |

102.70 |

6.5E+6 |

110.60 |

7.0E+6 |

118.50 |

7.5E+6 |

To launch 5kg of solvent and 7.5kg of API you would need to run 118 re-crystallization batches and get 100% recovery of solvent from each batch. That means you need the hardware to filter, purify and QC 590kg of methanol. In terms of mission duration, assuming you can run a 5kg cycle every 12 hours this would be a 59 day mission time. Obviously Varda could increase the reactor volume to shorten the mission duration, but processing that volume of solvent continuously would require some robust hardware as it cannot be maintained during the mission.

Ok, ok let’s talk about money finally…

Unit economics

Now that we’ve established some of the parameters and dependencies for missions, let’s now apply some figures about costs and value to estimate some margin ranges and market relevant dependencies.

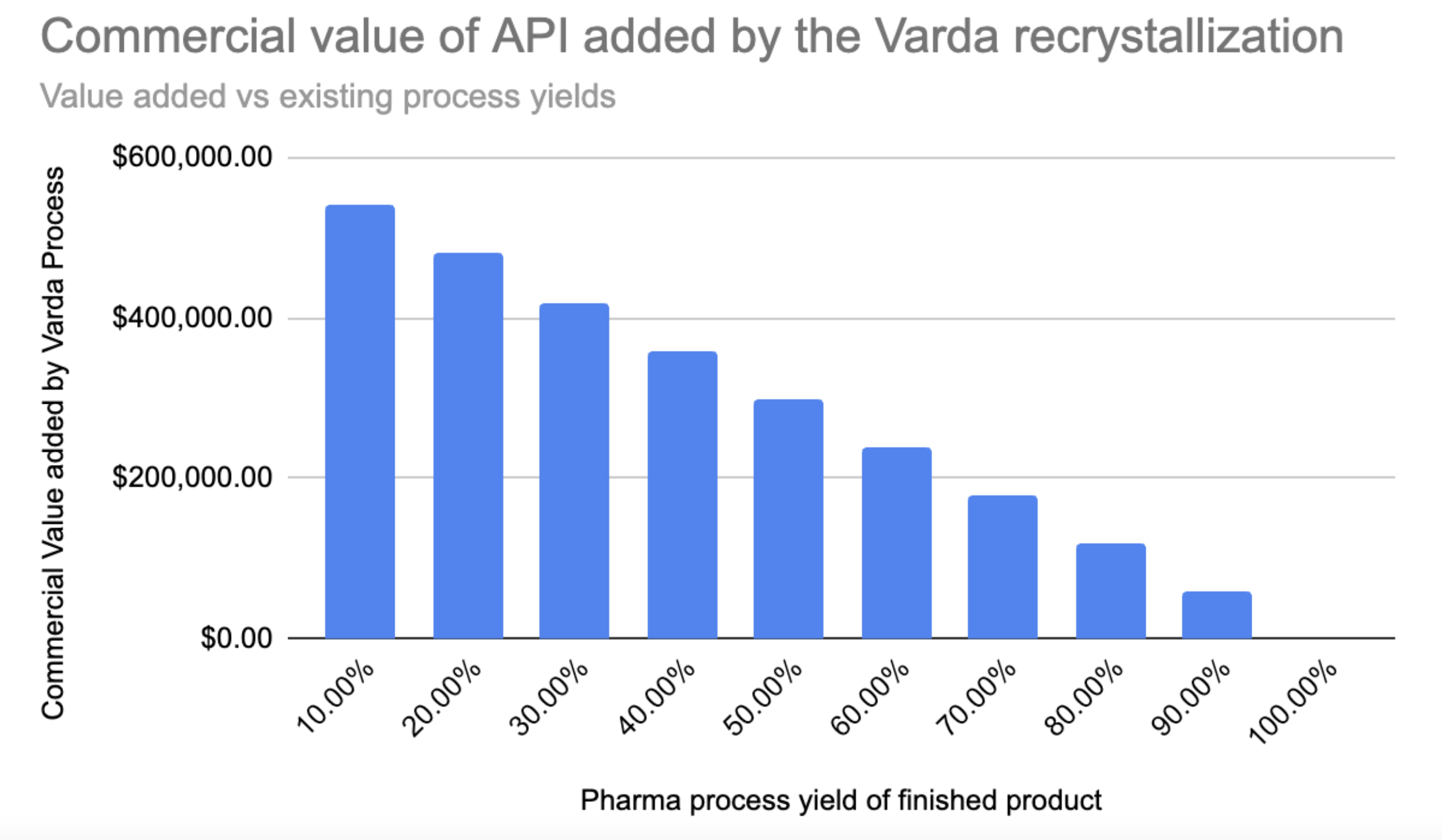

Price and Value to pharma manufacturing

Let’s say we are a CDMO or a pharma company doing production manufacturing and our crystallization process results in a bimodal distribution of particle size, and let’s say that the mass of the API is split 50% across the distributions. Let’s talk about our options:

1) The batch is spoiled, destroy it, resulting in 100% loss of product

Total loss of product is unlikely as you can recover the product by filtration, solubilize and re-crystallize. Now if your process continually produces a mixed population and for some reason you are not able to filter out the particles of interest then potentially you’re stuck here and you need to re-engineer your process or potentially look to Varda.

2) 50% of the API mass is finished product, 50% is spoilage

In this case it is assumed that you can filter off 50% of finished product and the remaining 50% is non-recoverable potentially because it cannot be recovered by filtration, or if it can be then perhaps it cannot be solubilized back into a solution.

3) 50% of the API mass is finished product, 50% is recoverable and possible to re-process.

This seems to be the most likely situation that existing methods are in today obviously with varying distributions of polydispersity. The question is what options do process engineers have to deal with the recovery of out of regime populations and how to treat them to get them into a finished product regime.

This third case is highly competitive for Varda, if a process engineer can fix this through modifying their pipeline with a fixed asset they can amortize that cost over the lifetime of the pipeline (and potentially other APIs) rather than paying it as an operational expense to Varda.

There are a couple of solutions out there for addressing polydispersity in particle size including spray drying and milling of solids. In the oft cited Keytruda study on the ISS they reached this outcome:

“These results have been applied to the production of crystalline suspensions on earth, using rotational mixers to reduce sedimentation and temperature gradients to induce and control crystallization. Using these techniques, we have been able to produce uniform crystalline suspensions (1–5 μm) with acceptable viscosity (<12 cP), rheological, and syringeability properties suitable for the preparation of an injectable formulation” https://www.nature.com/articles/s41526-019-0090-3

The authors used microgravity as a research environment to ultimately tweak a terrestrial manufacturing environment, a case that might be very common in the future but may not be the rationale to move that production step into microgravity.

Let’s look at value added by Varda based on the amount of value recovered, this would be the case where this API product would be lost without the involvement of Varda, which is the most favorable case for them. The cases become more competitive where other terrestrial crystallization solutions can be brought in instead of Varda.

Assuming for a typical mission with current specs

Payload Mass: 120kg

Fraction of Payload as manufacturing materials: 25%

API: Ritonavir

Solubility: 10mg/mL

Solvent: Methanol

Ritonavir commercial value: $1.58/mg

Finished product dry mass: 380g (100% recovery)

No solvent re-use

Fig. 7 - Commercial Value added by Varda vs terrestrial process yield At 10% the customer is spoling 90% of their product, at 100% they have no spoilage

Fig. 7 - Commercial Value added by Varda vs terrestrial process yield At 10% the customer is spoling 90% of their product, at 100% they have no spoilage

Ok so taking a pharma process yield of 50% (spoiling the remaining 50%) that means that using Varda a customer could recover $300k in commercial value of the product, under the given mission specs. Again this is poor because of the small amount of API being launched due to the mass requirements of the solvent needed.

How much would a customer pay to recover an additional $300k of product? Up front it sounds good, if 50% of the product will go to waste you could pay up to 90% of the recovered loss to Varda for that process, perhaps $270k. The downside is that you have to risk the finished product you could have made in your existing process by sending it into space, unless you separate from your terrestrial process. Additionally you have the overhead costs of maintaining the relationship with Varda, the supply chain dependence on a single vendor, the batch logistics of a Varda mission compared to your potentially continuous manufacturing process on Earth. Does this supply chain dependence warrant the investment from a pharma company?

How much money does Varda want to make per mission?

Costs to Varda

The costs to Varda aren’t transparent right now but the main cost being discussed is the payload cost for launching to space.

“The ramp has been particularly steep since 2018, when SpaceX launched the Falcon Heavy, bringing launch costs down from 10x from the turn of the millennia, to $1,500/kg. On April 20 of this year, SpaceX launched its first orbital test flight of the tallest and most powerful rocket ever flown: Starship”

So for a 120kg payload mission (current spec) that is $1,500/kg * 120kg = $180,000

There are also unknown costs associated with each mission:

- Unit cost of the Rocket Lab Photon unit

- Unit cost of manufacturing module, which in a video with Jesse Michels https://www.youtube.com/watch?v=6W2eFquzK6E is apparently destroyed on reentry

- Cost per recovery mission, currently from a US Gov location

Gross profit margin model

Why am I calculating gross profit margin? Not much is published about G&A and capital costs to manufacture the fab and recovery units, so this is the best we can do.

Let’s first look at what could Varda charge per mission. There could be a number of different models such as fixed capacity, cost plus, or some percentage of the value delivered. Given the NotBoring substack citation of the commercial value of APIs I am assuming Varda would want to charge some fraction of the commercial value of the API. So what would mission revenue look like across a range of that commercial API value fraction?

Assuming for a typical mission with current specs

Payload Mass: 120kg

Fraction of Payload as manufacturing materials: 25%

API: Ritonavir

Solubility: 10mg/mL

Solvent: Methanol

Ritonavir commercial value: $1.58/mg

Finished product dry mass: 380g (100% recovery)

No solvent re-use

Customer terrestrial yield: 50%

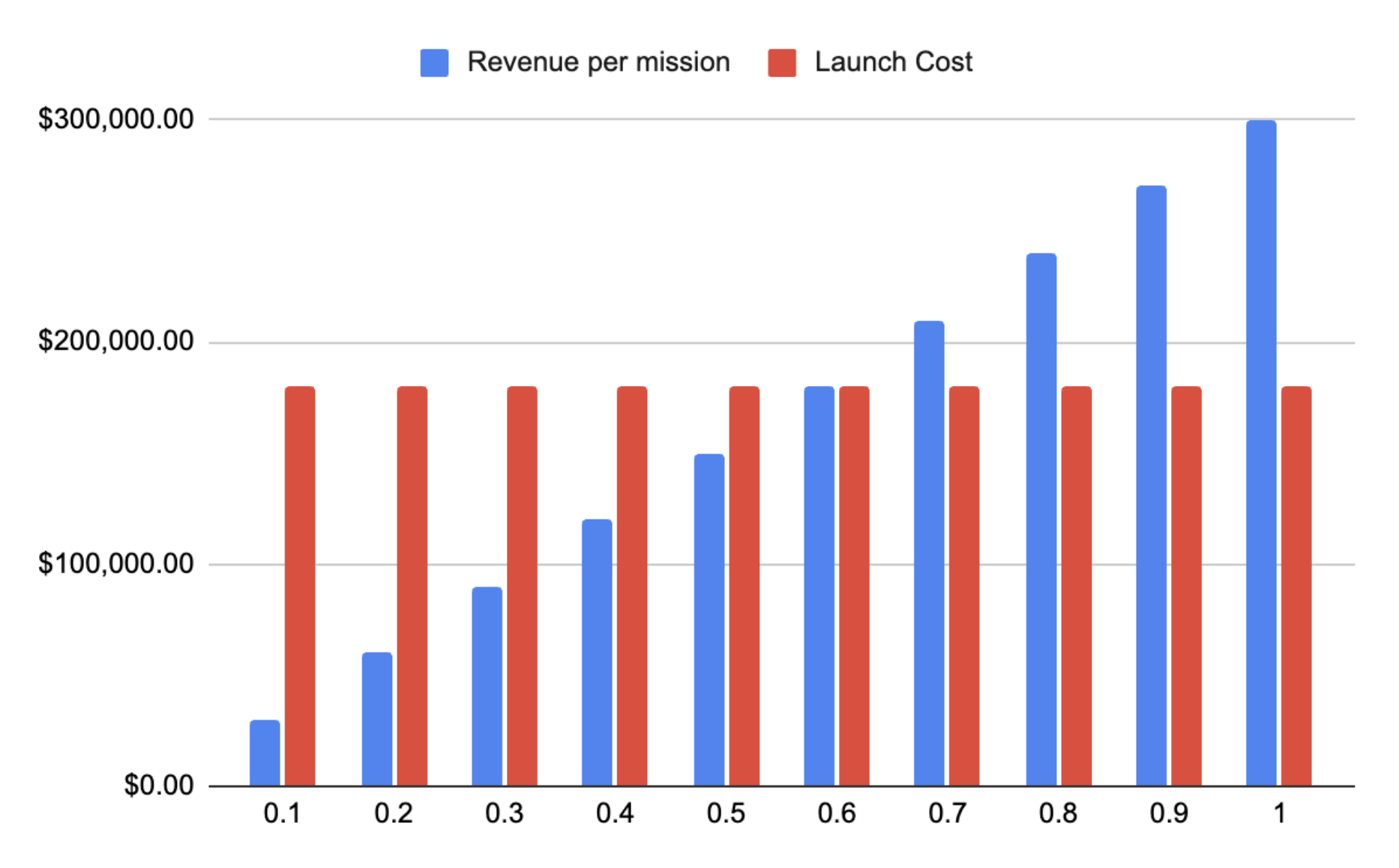

Estimated revenue per mission vs the fraction of the commercial value of API delivered to a customer

Fig. 8 - Revenue to Varda vs their take rate fraction on the commercial value of the API Sweep through various fraction take rates that Varda could charge based on the commercial value of the API they produce for their customer.

Fig. 8 - Revenue to Varda vs their take rate fraction on the commercial value of the API Sweep through various fraction take rates that Varda could charge based on the commercial value of the API they produce for their customer.

In the above chart assuming that the customer has a terrestrial yield of 50%, Varda can deliver 380g of API to recover that lost yield. Along the x-axis we scan across the percentage of the commercial value of that API from 10% to 100% (I’m calling this the “take rate”) to identify where Varda will break even if they charge that fraction of finished product. In this case if Varda charged their client 60% of the commercial value of the API delivered they could break even on the known costs.

Is Varda’s rate competitive with terrestrial alternatives?

At a 60% take rate customers would be paying around $190,000 per mission to get 380g. This would be a 40% margin to the pharma company but at this range there would be significant pressure to find a terrestrial solution where the cost of that solution can be heavily amortized. Personally I feel like 60% would seem unreasonable given the overhead of logistics to bolt on to the existing terrestrial pipeline.

Without specifics on the pricing of terrestrial next best alternatives it is difficult to say concretely however here are some details that make this difficult for Varda.

- Charging 60% of the finished product value (to break even) to the company that took on the bulk of the manufacturing process seems a hard pill to swallow.

- Customer’s already have manufacturing facilities and infrastructure set up to produce API at scale under certification, adding an additional process like spray drying is logistically easier to manage than working with a third party sending API into space.

- If adding a spray drying device, this could be CapEx up to $10mm which would be the same as 10 missions with Varda.

How do Varda’s Margins compare with industry norms?

For better or worse the market will want to benchmark you; it seems a typical terrestrial CDMO would see approximately 70% gross margin on their business based on the cited report.

“For all drugs combined, gross margins are highest for manufacturers at 71.1%, followed by insurers (22.2%), pharmacies (20.1%), PBMs (6.3%) and wholesalers (3.7%). Net margins are significantly lower for all parties, ranging from 26.3% for manufacturers to 0.5% for wholesalers”

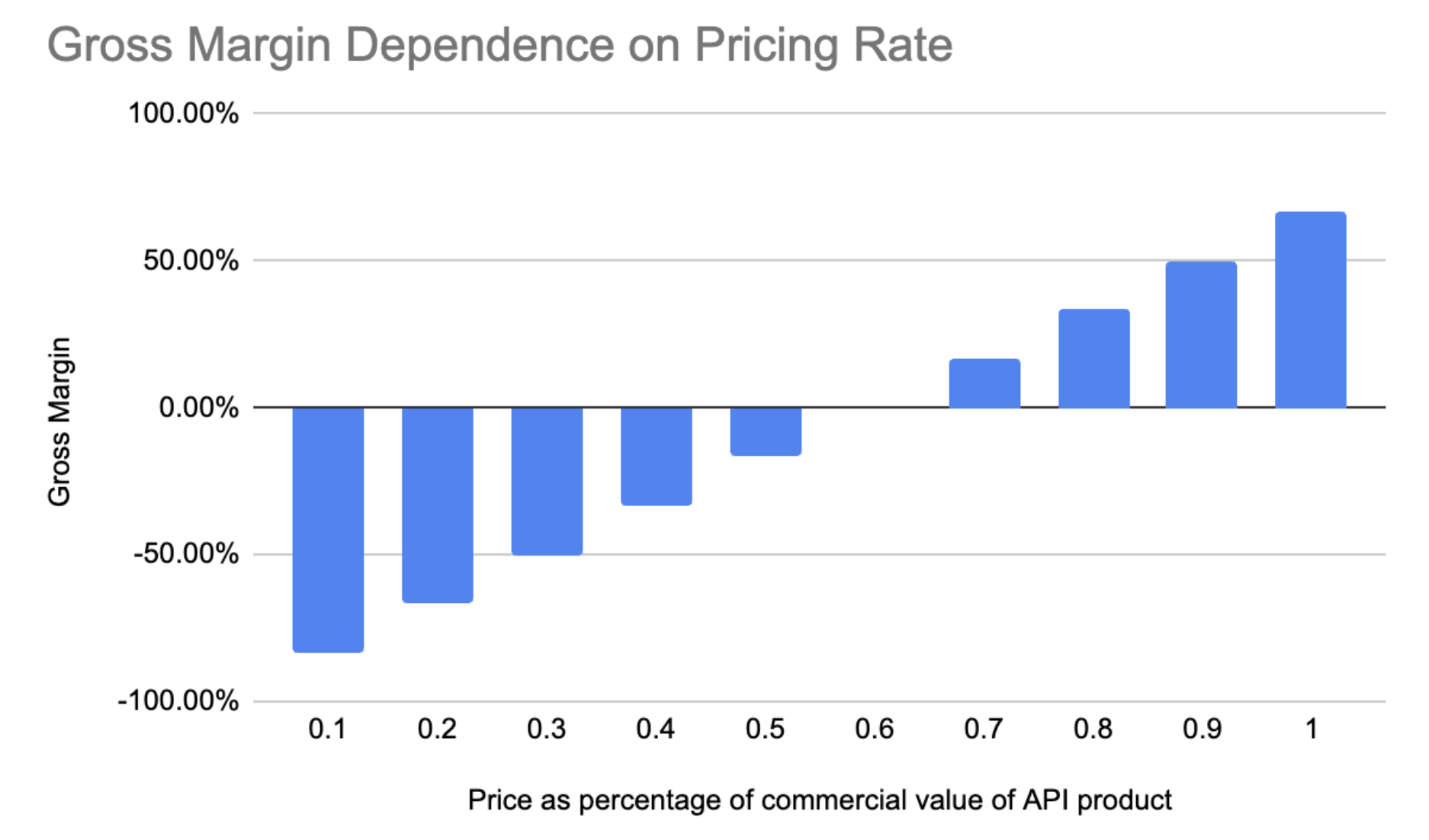

Let us now look at the gross margin % dependence on the take rate of the commercial value of the API.

Params

Launch cost: $1500/kg

Payload Mass: 120kg

Fraction of Payload as manufacturing materials: 25%

API: Ritonavir

Solubility: 10mg/mL

Solvent: Methanol

Ritonavir commercial value: $1.58/mg

Finished product dry mass: 380g (100% recovery)

No solvent re-use

Customer terrestrial yield: 50%

Fig. 9 - Gross Margin vs Take Rate fraction This graph shows the gross margin Varda could secure across a range of different take rates on the commercial value of the API produced.

Fig. 9 - Gross Margin vs Take Rate fraction This graph shows the gross margin Varda could secure across a range of different take rates on the commercial value of the API produced.

From the above chart if Varda wants to hit the CDMO benchmark of around 70% gross margin the take rate would need to be in the ballpark of 80% of the commercial value of the API, which would be untenable to customers.

What if launch costs are 10X cheaper?

Varda communicates its intention to ride the declining cost curve of payload costs, this is made clear and in fact Delian, the Co-founder highlighted this in response to Corin Wagen’s blog post.

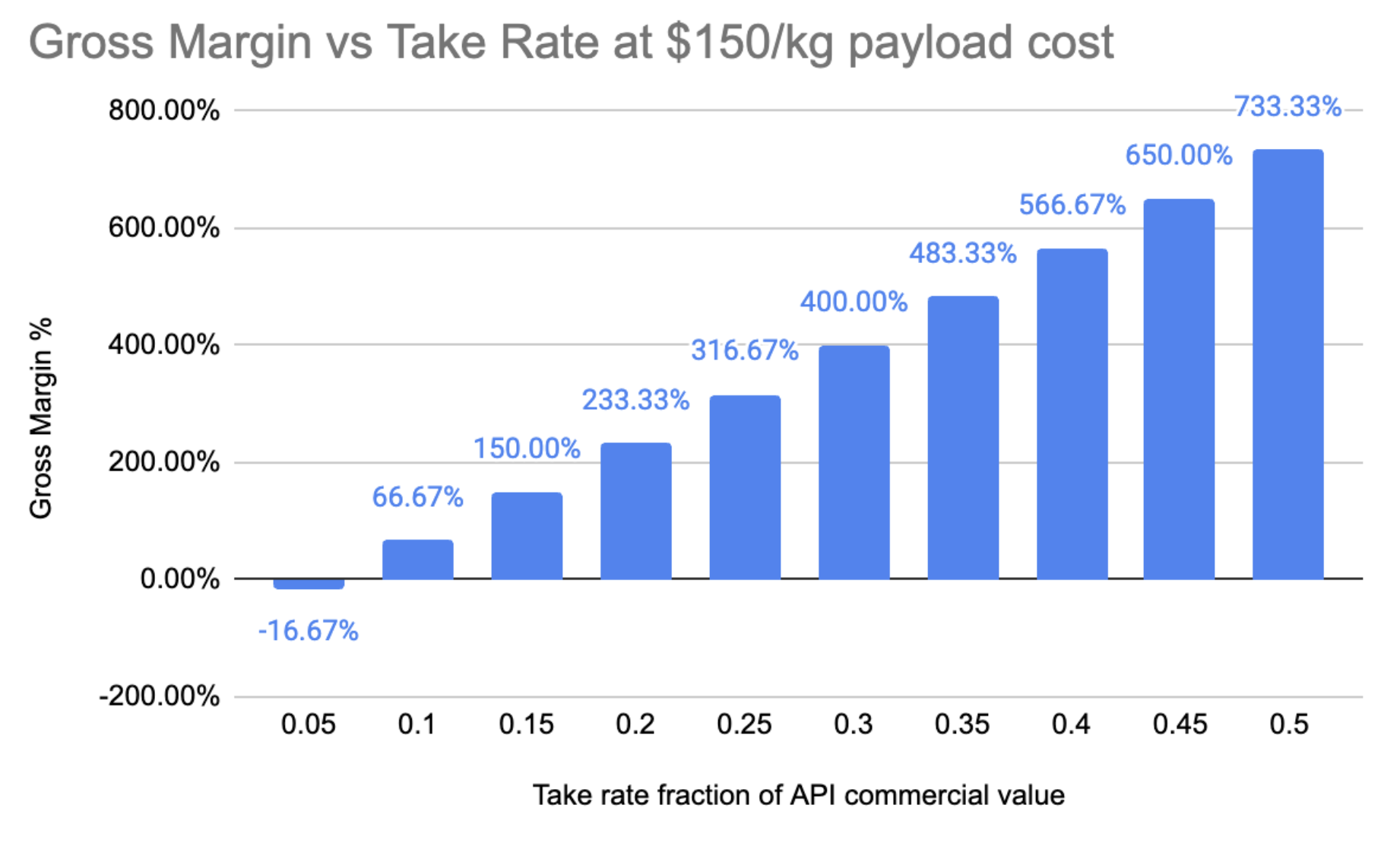

With that in mind let’s look at the case for where the take rate needs to be for Varda to make a 70% gross margin.

Params

Launch cost: $150/kg

Payload Mass: 120kg

Fraction of Payload as manufacturing materials: 25%

API: Ritonavir

Solubility: 10mg/mL

Solvent: Methanol

Ritonavir commercial value: $1.58/mg

Finished product dry mass: 380g (100% recovery)

No solvent re-use

Customer terrestrial yield: 50%

Fig. 10 - Gross Margin vs Take Rate fraction at payload cost of $150/kg Gross margin vs take rate but at $150/kg launch costs, a predicted 10X reduction on today’s cost.

Fig. 10 - Gross Margin vs Take Rate fraction at payload cost of $150/kg Gross margin vs take rate but at $150/kg launch costs, a predicted 10X reduction on today’s cost.

At payload costs 10x lower than today, Varda would be in the range of market benchmarks for pharmaceutical manufacturing at a 10% take rate on the commercial value of the API being delivered to their customer. This to me looks like a lot better territory to be in from a financial point of view.

What if the API is a biologic like Keytruda?

Varda mentions that they have ambitions to be in biologics like Keytruda. Biologics generally are more difficult to crystallize and more sensitive than small molecule drugs therefore the logistics likely will be more complicated. For example when solubilizing the drug the temperature of the solvent cannot go as high as it can for a small molecule. Purification and solvent recovery may become more difficult as mixtures of multiple different components may be required.

For example here is the preparation for Keytruda crystallization from the ISS and Merck study:

“Preparation of PEG 3350 batch crystallization formulations (1 ml bottles): to a 1.5 ml Eppendorf tube were added 333 μl of a solution of pembrolizumab at 20–40 mg/ml, in 20 mM histidine, pH 5.4, followed by the addition of 666 μl of 10.18% PEG 3350 in 50 mM HEPES, pH 7.7, and 100 μl of 2.5% caffeine in 20 mM histidine, pH 5.4” Reichert, P., Prosise, W., Fischmann, T.O. et al. Pembrolizumab microgravity crystallization experimentation. npj Microgravity 5, 28 (2019). https://doi.org/10.1038/s41526-019-0090-3

You can see that the 20-40 mg/mL solubility is better than Ritonavir. When it comes to $/mg of API biologics command higher prices commercially as well, drug du jour Wegovy for example has a list price that works out at $140/mg at a 2.4mg dose. Data from https://ro.co/weight-loss/wegovy-cost/

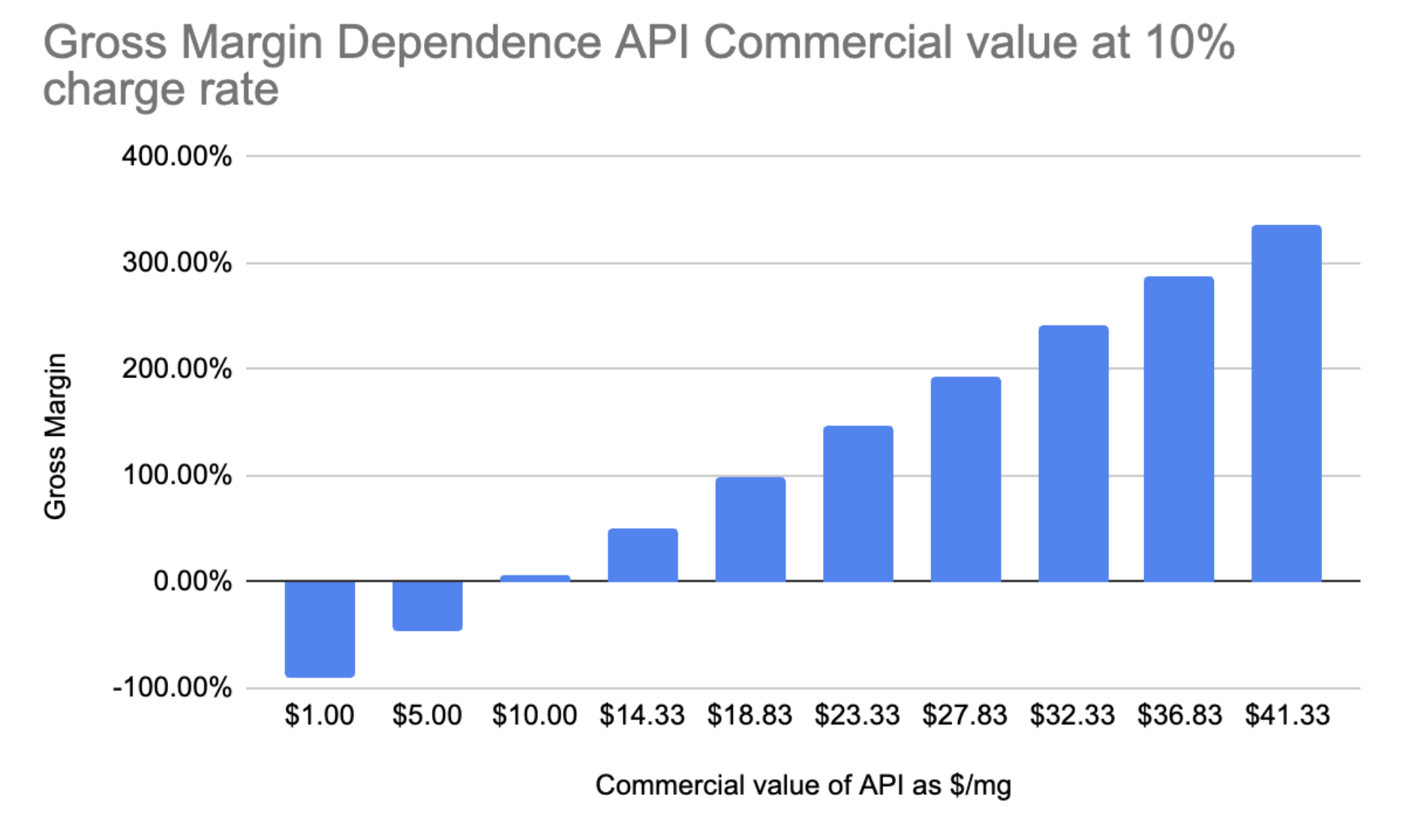

With API commercial value getting up to $140/mg let’s look at the gross margin dependence on API commercial value.

Params

Launch cost: $1500/kg

Payload Mass: 120kg

Fraction of Payload as manufacturing materials: 25%

API: Ritonavir (physical properties only)

Solubility: 10mg/mL

Solvent: Methanol

Finished product dry mass: 380g (100% recovery)

No solvent re-use

Customer terrestrial yield: 50%

Take Rate: 10%

Fig. 10 - Gross Margin vs API commercial value Gross margin vs API commercial value at today’s mission spec.

Fig. 10 - Gross Margin vs API commercial value Gross margin vs API commercial value at today’s mission spec.

At a 10% take rate Varda could hit a benchmark gross margin at an API commercial value of $14-18 /mg. If they were crystallizing Wegovy at a 10% take rate they would be doing exceptionally well.

My guess is the hardware and environmental requirements is more complex for a biologic vs Ritonavir therefore the time isn’t right for that, otherwise Varda would have just replicated the Keytruda study. Additionally the solubility is still an issue and the burden of solvent recycling may be more difficult for a biologic given the number of additives in the mixture (PEG, HEPES, buffer solution etc.)

Summary

This was a much longer post than I thought it would be but I hope you are still with me. What should the takeaways be:

- Definitely ride the launch cost curve down, it will only help and at 10x reduction is very beneficial to lowering the price to the customer and helping the margin of Varda. Hitting 10X cost reduction seems like the brute force approach to making this palatable from a financial point of view.

- Solubility is a real pain, if only using solvent once, sending up 100-1,000x solvent as API is a waste of mass budget, I hope Varda is considering means of solvent re-use and ways to certify the quality of the re-used solvent. However processing 50-100 batches of recrystallization will draw out the mission duration which may have a cadence mismatch with the rest of the terrestrial pipeline.

- API value, it certainly seems that skewing towards on-patent biologics will help with driving more value for customers, if there are significant, prevalent cases of polydispersity in biologics. The target range seems to be above $15/mg.

The outcome of the Keytruda paper was ultimately that microgravity is a research environment and terrestrial is the production environment. The barrier to adoption of using Varda is a mixture of cost, volume, production cadence mismatches, regulatory certification and typical OpEx vs CapEx trade offs when it comes to amortization. Until they demonstrate that you can crystallize in microgravity with incomparable results to what can be obtained on Earth, this barrier may be difficult to surmount.

Of course I provide this post from a point of view of analysis and seeking to explore the economics and the conditions of success. I wish the team the best of luck with their mission and again congratulate them on their progress so far on actually launching a mission.

Thanks for reading,

Ben